About Us

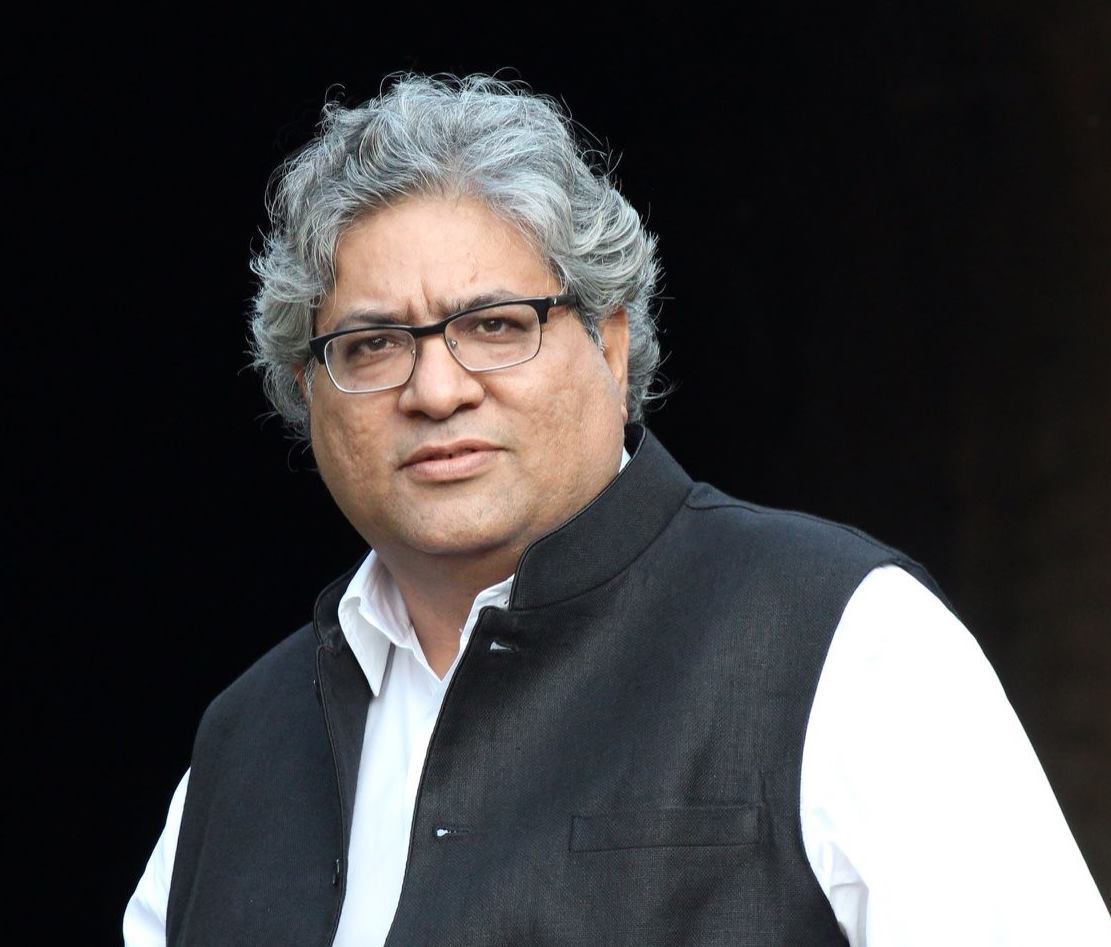

THE VETERAN

Tax-O-Legal is headed by Monish H Bhalla, who is a post graduate of science, and has served the Department of Customs and Excise and Service Tax for almost two decades. In the quest to become a part of the SOLUTION rather than the PROBLEM, he resigned from Government Service and laid the foundation of Tax-O-Legal. It began with the wish of providing legal consultancy in Indirect Taxation coming from his 33 years association with the subjects of Customs and Excise and Service Tax.

With the appreciation of seniors and his own thirst to do more, he took the road less travelled which aimed at educating everyone with his online modules on service taxes.

Monish Bhalla, an Expert in Service Tax, is also a prolific writer, who has written over 400 articles in regular columns for the leading daily newspaper, DNA.

The longingness of enlightening everyone with his knowledge motivated him to become author of the various books which are “Service Tax Clarifications” in the year 2004, “Commentary on Negative List based Service Tax” in 2012, “FAQ on Negative List based Service Tax” in 2013 and “GST the game changer” in 2015, GST Unplugged, 2017 and GST Decoded, 2020.

He constantly registers his appearance on leading TV channels including ‘Doordarshan’ and ‘All India Radio’ for his expert views on the complex subject matters.

He has chaired as a key speaker at various seminars and talk shows to express his expertise and knowledge among professionals and industrialists.

OUR ENDEVOURS

Since we aim for higher client satisfaction, our dedicated efforts have facilitated us to relieve many renowned organizations & businesses from their voluminous tax issues relating to Service Tax, Customs, Central Excise and GST. Bringing justice as well as saving a great deal to our clients enhances our brand image as an adept organization.

The ladder of success cannot be climbed with hands in one’s pockets. So precisely Mr. Bhalla explained the said words, ‘I didn’t get to where I am by thinking about it or dreaming about it. I got there by doing it’. Constant hard work and dedication aspired him to launch an interactive web portal named www.servicetaxonline.com. This was a Government Authorized Reporting and Publication Company that was accredited to publish all the judgements delivered by the various benches of Hon’ble Customs Excise and Service Tax Appellate Tribunal (CESTAT) of the country. The portal is the ultimate destination for anyone to find any information like, Act, Rules, Notifications, Circulars, Cenvat credit, Procedural norms, articles, related case laws and much more relating to older Indirect Taxes regime.